Verified Q4 2025 US Ticket Sales Performance

Why similar theaters produced measurably different outcomes under the same market conditions

Purpose

This page documents what materially changed during Q4 2025 for live theater operators and why outcomes diverged, even when demand and visibility appeared strong.

The analysis draws from verified ticketing data, publicly available economic indicators, and observed operational behavior inside live theaters during the quarter. No projections are included.

These patterns applied regardless of theater size, market maturity, or operator experience.

Executive Summary

Q4 2025 was not a quarter of disappearing demand. It was a quarter of uncertainty.

Buyers continued to show interest in live entertainment, but they became less patient with unclear, slow, or confidence-breaking purchase paths. Some theaters adapted to this shift and finished the quarter strong. Others saw flat or disappointing results despite increased visibility, promotional activity, or traffic.

What separated outcomes was not how much attention theaters generated, but how effectively their systems carried buyers through the moment of decision.

In many cases, the quarter was decided before checkout.

Most theaters experienced this effect during Q4, whether they recognized it at the time or not.

The Q4 US Economic Environment

The broader economic backdrop of Q4 did not signal a collapse in discretionary spending, but it did reveal growing pressure and selectivity.

According to data from the U.S. Bureau of Economic Analysis and the Federal Reserve, approximately 45% of U.S. consumer spending in 2025 came from households earning $250,000 or more annually. This segment continued to spend throughout Q4, sustaining demand for premium experiences, including live entertainment.

At the same time, financial stress increased among lower and middle income households. The Federal Reserve Bank of New York reported that auto-loan delinquencies reached their highest levels since the 2008 recession during Q4, signaling tighter liquidity and delayed discretionary decisions for many buyers.

In some regions, travel patterns added additional pressure. According to the U.S. Travel Association, inbound Canadian travel to the U.S. was down roughly 23% year-to-date, representing an estimated $4 billion loss in economic activity and about four million fewer visitors. In markets with heavy Canadian tourism, this translated into reduced foot traffic.

Advertising costs also rose sharply. Meta’s Q4 earnings disclosures showed roughly a 21% year-over-year increase in advertising costs, raising the break-even threshold for theaters dependent on volume rather than efficiency.

Consumer confidence did not collapse, but it became volatile. Decision windows shortened. Tolerance for uncertainty dropped.

The result was faster abandonment when confidence broke.

Why Q4 Masked Structural Weakness

Q4 was widely misread because most operators were reacting to delayed indicators.

Traffic counts, revenue totals, and platform dashboards report completed transactions. They do not surface hesitation, confusion, or abandonment that occurs earlier in the purchase path.

By the time revenue confirmed a problem, the structure of the quarter was already set.

Q4 did not punish slow reaction. It punished late visibility.

Where Performance Actually Separated

Across observed theaters, outcomes separated before checkout, not at it.

Under similar demand conditions, theaters that preserved momentum through the decision window converted uncertainty into completed purchases. Those that allowed friction, ambiguity, or delay absorbed higher costs without proportional lift.

In practical terms, this separation showed up in small but decisive efficiency differences. A change from approximately 1.3% to 2.6% in sales efficiency roughly doubles ticket sales from the same traffic base while lowering effective cost per sale. No increase in demand was required. No pricing changes were involved.

Observed Q4 efficiency bands:

Most theaters fell into one of these ranges during Q4, regardless of size, reputation, or demand.

Very few operators could accurately identify which range they were in before seeing the data.

• Legacy paths: ~0.8% to 1.5%

• Clean paths: ~1.6% to 2.4%

• Optimized paths: ~2.5% to 3.6%

• Top performers: ~3.7% to 4.7%

Small efficiency differences produced large revenue divergence under identical demand.

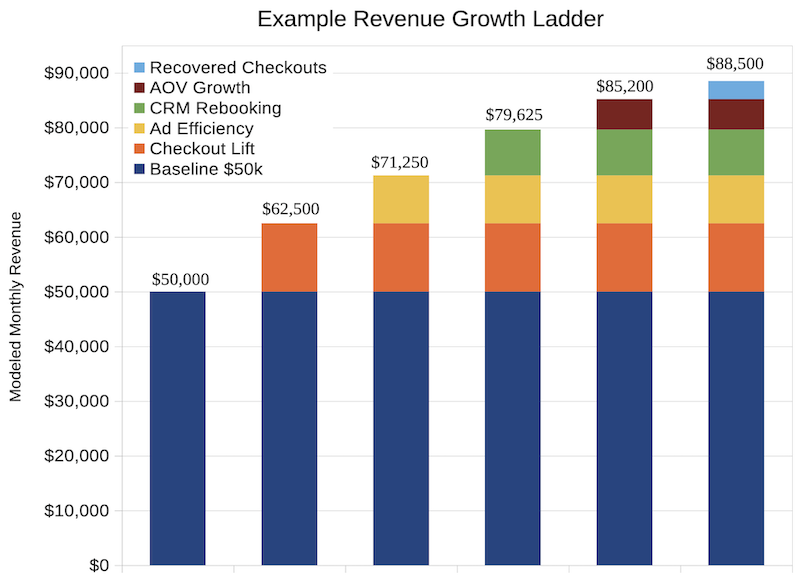

The chart above explains where outcomes separated during Q4. The graphic below explains why those gaps continued to widen after the quarter ended.

Efficiency improvements do not operate in isolation. Gains at checkout increase the impact of recovery systems, CRM follow-ups, and repeat purchase behavior. Each layer amplifies the next.

The example below illustrates how small efficiency gains can compound when demand stays constant.

Dollar values are normalized to show relative impact, not to represent any single theater.

Diagnostic Moments from Q4 Operations

During Q4, operators were frequently offered discounted opportunities to increase traffic through third-party discovery platforms. Diagnostic review showed that while exposure increased, very little of that traffic reached purchase-ready states. Completed sales showed minimal lift.

By staying focused on completion efficiency rather than surface-level visibility, these operators avoided committing resources and commissions to channels that added noise without meaningful signal.

In one anonymized case, the seating display was adjusted to better reflect how full the room actually felt, alongside a few other straightforward path improvements. Fewer seats appeared available, but the show looked active and credible.

That weekend generated roughly four times the ticket sales of any comparable weekend in the venue’s prior history. While multiple changes contributed, clarifying visible availability played a meaningful role in improving buyer follow-through.

The takeaway was not artificial scarcity. It was preserving buyer confidence at the moment the decision was made.

What Separated Strong Q4 Performers

• Purchase paths were shortened rather than expanded

• Confidence cues were clarified earlier

• Friction was removed instead of compensated for

• CRM and recovery systems quietly contributed approximately 8–10% of monthly sales

These theaters did not rely on more demand. They relied on cleaner completion.

Why This Still Matters

Efficiency compounds.

Systems that failed to expose friction in Q4 will continue enforcing the same ceiling, regardless of how demand shifts. Visibility alone cannot overcome structural inefficiency.

The market did not become unpredictable. It became less forgiving.

For higher-volume theaters, Q4 outcomes were rarely determined by demand. They were determined by where confidence broke before checkout, often earlier than expected.

What This Page Cannot Answer

Industry patterns can narrow the question. They cannot answer it.

The unresolved variable is how your own system behaved during Q4, where hesitation emerged, and which constraints were silently enforced.

That number already exists. Most operators only discover it after performance stalls.

Data verified from live WSO theaters. Figures are verified from tracked ticket sales and reviewed quarterly for accuracy. Results vary by market and execution, but efficiency always compounds.